KATHMANDU, Sept 23: Nepal Stock Exchange (Nepse) index shed 37.57 points this week to close at 1,766.91 points on Thursday -- the last trading day of the week.

The market, which fell by 1.64 points last week, dropped deeper this week as investors rushed to book profit from rising stock prices in the bullish market. Some stock brokers have termed the drop as the impact of the upcoming festive season.

The market opened for trading on only four days this week as Monday was a public holiday.

"The market generally goes down on the eve of festival seasons as many investors want to sell their holdings so that they have money at hand for the celebration," Anjan Raj Poudyal, former president of Stock Brokers Association of Nepal (SBAN), told Republica. "The correction has started a bit earlier this year compared to the previous years," Poudyal, who operates Thrive Brokerage Pvt Ltd, said.

Daily Commentary: Stocks extend losses as Nepse inches 7 points...

As the liquidity situation in bank and financial institutions is in a comfortable situation, investors are also feeling the pinch. "It seems that the investors are also reacting to the possibility of interest rate hike. So some investors want to sell their position before the liquidity gets tighter which is likely to impact the market," added Poudyal.

Most of the trading groups ended in the red zone this week. Manufacturing and Processing group led the losing side this week, as its sub-index shed 117.23 points to settle at 2,380.22 points. Banking, the heavyweight trading group in the secondary market, also ended 51.62 points lower at 1,661.26 points. The sub-indices of Hydropower and Development Bank also fell 42.4 points and 28.62 points, respectively, to settle at 2,392.86 points and 1,869.35 points. Similarly, the Finance group also shed 12.94 points to finish at 831.39 points. 'Others' group also went down 5.49 points to close at 777.41 points. Hotels and Insurance groups, however, logged gains of 26.98 points and 7.71 points, respectively, to end the week at 2,260.51 points and 8,983.37 points. Trading group remained unchanged at 202.79 points.

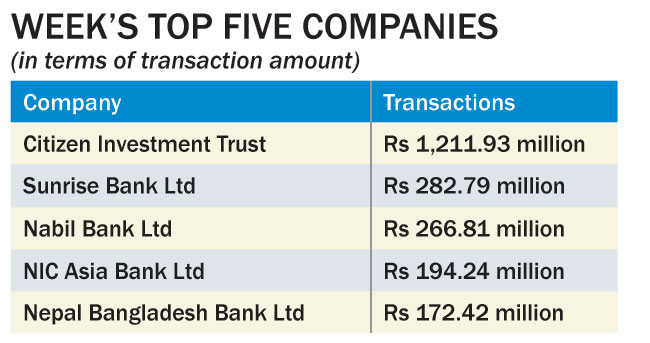

A total of 7.24 million units of shares of 152 companies worth Rs 5.65 billion were traded in the market this week through 23,885 transactions. Citizens Investment Trust, NIBL Sambriddhi Fund I and NIC Asia Bank Ltd led the list of companies in terms of turnover (Rs 1.21 billion), number of shares traded (863,000 units) and number of transactions (1,359), respectively.