KATHMANDU, July 2: Nepal Stock Exchange (Nepse) climbed up 38.06 points this week to close at 1,723.23 points on Thursday -- the last trading day of the week.

The benchmark index, which is on a bull run for the past few months, climbed to an all time high of 1,724.59 on Wednesday before shedding a marginal 1.36 points on the next trading day.

Analysts say that the stock market rally is mainly due to the investors' psychology that the stock prices would go up further in the bullish market.

Nepse posts weekly gains as investors shift focus to earnings

"There is a feeling among investors that the share price is increasing continuously and 'I should buy it now to cash in on the rising price'. This is generally what happens in the market," Gunanidhi Bhusal of Aryatara Investment and Securities Pvt Ltd, said. "There are many new investors in the market. They see their friends earning good profit which tempt them to pour their money into the stock market.”

However, the steep rise in share prices of most of the listed companies has drawn attention of the Securities Board of Nepal (Sebon) and Nepse, prompting them to caution investors before making investment. After two statements from the market regulator Sebon, the stock exchange company also issued a statement this week, urging investors to be cautious.

In the statement, Nepse urged the investors to trade securities of listed companies only after analyzing inherent risks, profit, security and liquidity, among other factors.

"Investors should also pay attention to the economic activities, and policies and regulations which also affect the activities of listed companies and their share prices. There is a high risk while making investment decision without making technical as well as fundamental analysis,” Nepse said in the statement.

However, the statement had little or no impact at all as all trading group ended on the green territory this week. Development Bank group was the highest gainer of the week as its sub-index shot up 80.36 points to close at 1,747.25 points. Insurance group followed the suit with its sub-index climbing up 73.5 points to settle at 9,553.11 points.

The sub-indices of Hydropower and Banking groups also ended 39.71 points and 36.01 points higher at 2,745.66 points and 1,567.03 points, respectively. Finance group also rose 24.41 points to end the week at 776.35 points. Hotels, and Manufacturing and Processing sub-indices also logged gains of 17.08 points and 13.23 points, respectively, to settle at 2,027.15 points and 2,407.34 points. 'Others' and Trading groups went up by 11.75 points and 1.41 points, respectively, to close the week's trading at 803.58 points and 202.79 points.

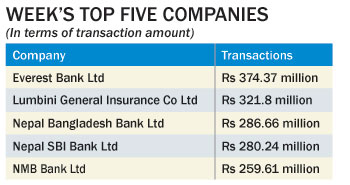

A total of 22.83 million units of shares of 150 companies worth Rs 8.38 billion were traded in the market this week through 32,839 transactions. The turnover is 7.32 percent higher than the last week.