KATHMANDU, July 23: Nepal Stock Exchange (Nepse) index climbed up 53.09 points this week to close at 1,798.83 points on Thursday.

The stock market rally continued this week as well with the benchmark index climbing to 1,800.47 points on Tuesday--the third trading day of the week. The stock market, however, went down in the next trading day before gaining 11.99 points on the last trading day of the week.

Stock market analysts say that the attraction of investors has shifted toward commercial banks from the microfinance companies after the Nepal Rastra Bank (NRB) capped interest spread of microfinance institutions at 7 percent. Through the monetary policy for 2016/17 on July 14, NRB, the central bank, has capped interest rate spread of microfinance institutions to seven percent, following complaints that they were charging exorbitant high interest rates. The interest spread cap is likely to squeeze profit of the microfinance institutions, thereby clipping their capacity to distribute dividends.

"Investors have shifted toward shares of commercial banks that are in the process of making public their financial reports of the last fiscal year. Investors expect that banks will report good profit and announce attractive dividends this year also. It is one of the reasons behind growing attraction of investors toward banking stocks, according to a stock broker.

“Shares of microfinance institution were overpriced as investors were expecting the central bank to increase their paid-up capital. That would have meant more bonus and rights shares for the investors,” the stock broker said, adding: “Instead, the central bank decided to cap their interest spread which drove investors toward shares of commercial banks and insurance companies."

Insurance sub-index was the biggest gainer of the week, as its sub-index jumped by 377.87 points to close at 9,052.09 points. Manufacturing and Processing group followed the suit with its sub-index going up by 206.77 points to close at 2,828.73 points. Banking, the heavyweight group, also ended up 70.56 points higher at 1,694.24 points. The sub-indices of Development Banks, Finance and Hotels groups also went up 28.53 points, 12.54 points and 12.74 points, respectively, to end the week at 1,769.3 points, 856.328 points and 2,034.31 points. 'Others' and Hydropower groups, however, went down by 38.17 points and 17.23 points, respectively, to close at 834.95 points and 2,647.55 points. Trading sub-index unchanged at 202.79 points.

Nepse up 79 points as investors turn to banking stocks

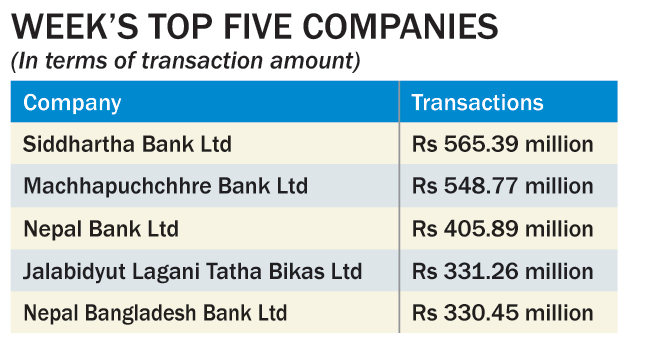

A total of 14.63 million units of shares of 151 companies worth Rs 9.37 billion were traded in the market this week through 42,649 transactions.

The turnover is 49.64 percent higher compared to last week. The turnover has been increasing in recent weeks due to full-fledged implementation of the dematerialized form of shares trading. Stock market analysts have attributed increment in turnover to rising share prices, flow of cheaper finance from the banking system to stock market, and growing confidence of investors toward the market.