The newly appointed Finance Minister, Dr. Prakash Sharan Mahat, is currently occupied with the process of formulating the budget for the upcoming fiscal year 2023/24. He has assembled a team of experts with diverse expertise in the domestic and internal aspects of the economy and public finance to assist him in this endeavor. This development can be regarded as a positive indication that he may present a more credible budget compared to those of previous fiscal years. However, the credibility of the forthcoming budget will rely more on his willingness and ability to resist undue political influences rather than solely on the expertise of his team members. This article aims to shed light on the issues concerning budget credibility in Nepal, in which the new finance minister can make valuable contributions towards improvement.

In recent years, it has become a common occurrence in Nepal to downsize the approved annual budget during the implementation stage without submitting a bill to the parliament for budget amendments. For the fiscal year 2022/23, the government reduced the budget from Rs 1793.83 billion to Rs 1549.99 billion, a reduction of 13.5%, without providing adequate justification or obtaining approval from the budget approving authority, which is the federal parliament. This practice has also been observed in the past two years, with a budget reduction of approximately 5.6% in the fiscal year 2021/22 and around 8% in the fiscal year 2020/21. This so-called downsizing of the budget midway through the fiscal year is being used as a means to conceal the government's allocative and operational inefficiencies, avoiding accountability to both the public and the parliament.

The Finance Act and Appropriation Act serve as fundamental legal instruments in ensuring the government's accountability to parliament when it comes to revenue collection and public expenditure. However, the Appropriation Act in Nepal contains several loopholes and ambiguous provisions, which enable the government to interpret them conveniently for purposes such as budget downsizing, resizing, and virements. Regrettably, the parliament is weak in its oversight, as no questions are raised in either house regarding these issues, including budget virements that exceed the legal limit of 10% between different grant titles. Parliamentarians appear to be unaware of their roles in improving public finance management. Instead, they tend to prioritize securing funds for their constituencies, allowing them to handpick projects based on their personal preferences. Their primary focus lies in the total budget figures and projects that benefit their own constituencies. The revenue aspect of the budget, even during the budget approval stage, does not seem to pique their interest. Consequently, parliament's contribution to promoting budget credibility is minimal at best.

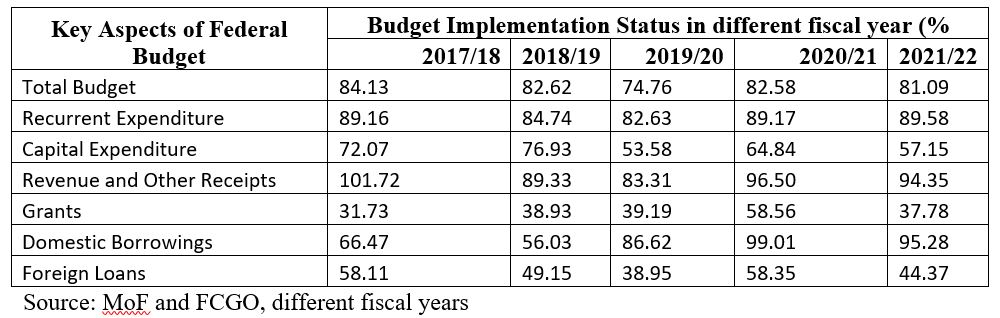

According to data from the Ministry of Finance and the Office of the Comptroller General, the Nepal government has consistently fallen short in fulfilling the commitments made to the public through the annual budget. The budget is essentially a promise made to the public, and when the allocated funds go unspent, it creates an atmosphere of distrust between the government and the public. Over the past five years, the government has only been able to spend a maximum of 84.13% of the total annual budget. In terms of capital expenditure, the government has fared even worse, with a maximum expenditure of 76.93%. In the fiscal year 2021/22, the capital expenditure was limited to a mere 57.15% of the estimated amount. This indicates that the government often formulates budgets without thoroughly analyzing its spending capacity. The practice of focusing on the size of the budget solely to appease the public has a detrimental effect on budget credibility. Furthermore, the unnecessary practice of downsizing the budget without adequate justification is redundant, as such issues can be automatically addressed during the process of revising the budget estimates for the subsequent budget formulation.

Shuffling the deck: On the Union Budget 2024-25

Until four years ago, Nepal's performance on the revenue side of the budget was generally commendable, with a few exceptions. In the fiscal year 2017/18, the revenue collection slightly exceeded 100% of the estimated target. However, in recent years, the government has been unable to sustain this level of success and has consistently failed to meet revenue targets over the past four fiscal years.

The table below shows the budget performance during past five years:

The performance of the Nepalese government in terms of receiving foreign assistance has been notably weak. Over the past five years, the government has consistently been unable to collect the estimated foreign grants. In the fiscal year 2017/18, the actual realization of foreign grants was less than one-third of the estimate, standing at only 31.73%. The government's achievement in terms of receiving foreign grants improved slightly in the fiscal year 2020/21, reaching 58.56% of the estimate, which was the highest in the past five years. Furthermore, the estimated foreign loans have not been obtained as planned. While the estimate of domestic borrowing has been raised in recent years, it has been done so with inadequate justification. This is because there is often a significant amount of unspent cash reserves, raising questions about the reasoning behind increasing the amount of domestic loans.

The facts and figures mentioned clearly indicate a decline in the credibility of our budget. It is crucial for the new finance minister to give proper attention to address this situation. The government should conduct thorough assessments of both revenue generation and the spending capacity of state machinery before making allocation decisions. Initiatives for reforming budget execution should be prioritized as a key program in the next budget. Efforts are needed to improve the management of foreign assistance. We have been unable to fulfill the basic requirements for disbursing grant commitments, which has led to donor agencies holding us accountable. Similar challenges exist with foreign loans, often tied to infrastructure projects that experience delays in completion. Therefore, the government must view the budget not merely as a number but as a tool to connect with the people and promote public trust. Instead of prioritizing the size of the budget, emphasis should be placed on allocative and operational efficiency. The focus should be on effectively utilizing resources and ensuring that projects are completed in a timely manner. By doing so, the government can enhance the credibility of the budget and foster public trust.

Members of Parliament must also fulfill their roles effectively to ensure budget credibility. The temptation to prioritize projects in their own constituencies or personally select projects can be detrimental, as it compromises their moral standing in holding the government accountable to parliament. This practice hampers budget accountability and fiscal discipline. However, if parliamentarians take a keen interest in the implementation status of the budget, including revenue, grants, and loans, and truly understand their oversight role, they can contribute significantly to promoting budget credibility. By actively engaging in budget oversight and holding the government accountable, MPs can play a crucial role in enhancing budget credibility and ensuring fiscal discipline.